I am very pleased to present another guest post from our good friend in Israel, The Male Brain. He has taken the time to translate an article from an Israeli finance and money blogger, analysing the collapse of Silicon Valley Bank, and its implications for the broader banking industry and beyond. TMB has also added his own comments down at the bottom. I have appended additional commentary there as well.

My gratitude as always to our good friend for his sterling contributions to this site.

A Chronicle of the Bank Run

Dorin Hartmann aka HASOLIDIT, which in Hebrew translates to “The Moderate One”, with respect to investments. The original post, in Hebrew, is here.

Foreword by TMB

Ms. Hartmann is the Israeli representative of the “Early Retirement Extreme” philosophy. Her blog has been around for 10 years, and as it seems she puts her money where her mouth is.

She writes and manages a forum dedicated to how to save money, invest with minimal effort (and cost) and live a simple life.

I’ve been following her for ~7 years. Her tips are usually spot on, but sometimes “too extreme”. This post was written on March 12, but is “always relevant”.

Intro

Greg Becker still tried to calm everybody down.

One day after his bank – Silicon Valley Bank (SVB) – eliminated 60% of his market worth, the veteran CEO asked hi customers to “Stay Calm“. “The bank has enough liquidity to support our customers at this time”, he said, “On one condition: If everyone says SVB is in trouble – it will be challenging”.

That didn’t work out. 24% of deposits were withdrawn that day. SVB finished with a net negative cash balance of US$958M. The following day the regulator pulled the plug, and it has gone to chapter 11, stock is frozen and will probably never be bought and sold again.

This is the cruel dynamic of Financial Panic: If you believe your money is at risk, you’ll withdraw. But if enough people share your opinion, no one can withdraw. So just worrying about a bank collapse, can by itself collapse a bank. In this case – the second largest collapse in US history.

What Happened

SVB is no crypto market. It was a veteran institution, 18 largest bank in the US (with 209B$ deposits) and part of S&P500. His management was considered conservative and it passed the DotCOM bubble and the 2008 crisis very well. It specialized in providing financial services to the VC and private equity firms and was positioned as the leading bank in that niche. Thousands of startup companies relied on money in that bank, for payroll among other activities.

In order to understand its failure we need to look back a few years. The flood of liquidity in the recent years reached SVB. The bank tripled its deposits between 2019 and 2021.

I a crude sense, when you deposit money to the bank, the bank uses it for additional yield. E.g. giving it a lone and collecting interest. This is one of the types of bank profits: It pockets the arbitrage between the interest it pays me and the interest it charges the other guy.

Since most of SVB clientele are startup companies, who already raised capital, they don’t need additional funding. So SVB chose to invest the liquidity in US treasury bonds of medium and long term. Seems like a very solid and risk free investment.

However, the bank bought those bonds when the interest was almost zero. As we may know there is a reverse correlation between interest and bond prices. The lower the interest, the higher the prices and the lower their yield (and vice versa).

SVB increased its bond position 7 folds during a historical low of bond market. It found itself holding a massive bond portfolio which was mostly bought at record prices (and low yield). Just to put a number on it – SVB purchased 10 year treasury bonds with a yield of 1.63%.

The inflation caused the central bank to raise interest rates, trying to “cool the market”. In 2022 the bond market went down. This makes sense, why should I buy bonds that pay 3% iif I can buy a new bond that pays 5%? The only way that the “old” bond can compete with the “new” bond is if its price drops and its yield becomes equal.

This is how SVB found itself with “on paper” loss of 16B$ on its bond portfolio – way more than its equity. In principle, bonds are liquid and if you didn’t sell you didn’t lose. Banks are not required to recognize loss on their balance sheets as long as they hold them (to maturity). You just wait it out, collect coupons and get your money back at the end.

This was the banks plan, which will be great and no loss will be incurred. Works great – unless you HAVE to sell. As the interest rose, more clients did not find an annual 2% deposit favorable. More and more companies withdrew their deposits to alternative investments. Financial funds are now yielding 4% and treasury bonds of 1 year are now 5%.

This means that the bank requires liquidity. So SVB went public issuing stocks of 2.25B$. This startled the market and crashed the stock price 60%. The rate of withdraws increased. Leading investors such as Peter Thiel urged their portfolio companies to withdraw. So the bank had to sell its bond portfolio at a loss of 1.8B$ to supply liquidity. Once it failed to supply it, the FDIC took over.

It wasn’t a scam or a fraud. The bank crashed because it borrowed short term and lent long term. The bank was flooded with short term deposits, which can be withdrawn in an instant, and purchased longer term assets, with way too long time to mature. It is a risky strategy, and unfortunately the risk materialized. The bank under assessed the risk of withdraw as well as a raise in the interest that will force it to sell the bonds.

What’s Next?

This is rolling event, and no one knows where it ends. I’m not predicting anything, but I have a few random thoughts on the subject:

How unique is it to SVB and what is the threat to the banking industry?

People are quick to compare it to 2008 and the Lehman Brothers collapse. One can see why: Banks seem like the type of business that should enjoy interest raise, and here we are surprised to find that it isn’t so. Add to that the psychological effect of those astonishing (for the worse) of SVB stock and other banks, not to mention the Déjà vu of 2008.

I don’t see it like that. SVB is no Lehman brothers. Lehman took deposits, leveraged them 13:1 and bought worthless sub-prime based mortgage bonds. SVB bought unleveraged treasury bonds, completely solvent, that just went down due to sharp interest raise. SVB fell due to liquidity, Lehman were reckless and insolvent.

To hammer the point home, regulations 15 years ago were nothing like today. Leverage was way higher and so was the risk taking. No one foresaw a credit crisis and you got a lone if you had a pulse. Banks are a lot more careful today and are doing way better on stress tests. If small banks will continue to fumble, we will see the big ones cashing in on the deposits.

However, the situation is not that bright. Many banks, such as First Republic and Charles Schwab are carrying bond losses, and the only difference between them and SVB is that no has (yet) initiated a run-on-the-deposits.

SVB was unique in a sense because its client base was undiversified (mostly start-up companies) and that it was a small amount of clients with a big amount of deposits per client. It’s not a nice thing to say, but it is a good thing that the bank passed away. The same way forest fire burns down dead wood. Assets are repriced, businesses (including banks) fail, and capital flows to better businesses. Brutal, but this is how the capitalism works. And it is not like 2008 when something actually broke.

What will the Fed do?

The Fed is caught between the hammer and the hard place. Hawkish position – going on with interest raise (according to plan) and even keeping it as is – may escalate the crisis with small banks having a losing bond portfolio, and tech corporations who were the customers of SVB. On the other hand – lowering the interest may get the inflation out of control. Complex problem.

Maybe no place is safe

I’m against the legal reform, and beside am very against initiating an economic collapse of Israel’s finance infrastructure as an opposition tactic. [TMB – this is an issue for a different post. The short version is that changes to the legal system, initiated by the new Right-Wing government, have caused massive protests and some high-tech companies said that they’ll take the money out of the country]. I’m not sure how people like Einat Guez sleep at night now, after they called in the market square to send funds abroad as an opposing tactic. [TMB – Einat Guez is a founder and CEO of a unicorn, which spoke first against the government and said that it will take the corporation funds out of Israel]. This is a great reminder that financial risk, just like energy, cannot be undone, it can only be mutated.

How much of high-tech industry is a tower of cards built on zero interest sands?

I can’t imagine being SVB customer now [TMB – the article was published on March 12]. I’m a CEO and all the money is in a respectable American bank, and I couldn’t take it out on time. NOW WHAT?

Most startups are not profitable – they can’t pay expenses out of their revenues. The funds “stuck” in SVB come from investors. The companies were counting on those funds to reach profit. I hear it is getting hard to raise capital (unless you are in a hot niche like AI) and most tech companies have already tighten their belts.

All eyes are on the VCs: will they open their wallet and provide liquidity for those stuck corporations?

This event mostly confirms my opinion to avoid exposure to loosing tech companies and increase my position on oil, cigarettes and railroads on my portfolio. [TMB – she is cynical but has a point].

What does it means to investors?

I’m not changing my investment strategy after SVB. If I have spare money, I’ll invest it in order to hold stocks for 10 years and more. Moreover, 2023 is looking like a bumpy year. I don’t know if we will see another crash due to this or other episodes. I do know that a significant crash might be a lucrative opportunity if you can master your emotions and stay when everyone else wants to leave.

Pessimism equals lower stock prices. The current interest and the events it generates creates intended pessimism to lower inflation. Pessimistic environment is great for investment because you can buy quality stock on the cheap. Not intuitive, but this is how it works.

This time is also a good opportunity to reevaluate how much risk you are willing to take and withstand.

TMB Conclusion

Leaving the SVB issue apart, this event shows that diversity is our strength – when it comes to investments. As I see it, one should have more than one place where one keeps his money.

I may write a post to explain WTF is happening in Israel (Tl;DR loosing left tries to break the rules, but has some points). In the meantime, this may not be a “good year” financially.

Ms. Hartmann, AKA Hasolidit (translation – the solid one, or the equal headed investor) has a vast number of articles on how to save money, how to invest it with minimum premium to banks and investment firms and all in all to help people not spend their life away.

The Didact Speaks

I think Ms Hartmann raises a number of interesting points, some of which I hope to address in my next podcast, which should be up later this week.

The first point to note is the fact that SVB took several donkey-punches from the Fed on its portfolio of extremely liquid, completely riskless (supposedly) Treasury bonds, and this happened because of unrealised losses on what financial markets universally believe to be essentially cash-equivalent risk-free securities.

How did this happen?

Banks have to mark their bonds to market prices every day. If bond yields go up, as the Fed hikes interest rates, then bond prices go down. This is an absolute and unbreakable law of money, because you discount cash flows according to the carrying cost of money, i.e., the interest rate for any given lending period.

So, if you hold onto lots of bonds, you then end up marking down your portfolio of bonds. BUT – and this is critical – these are “paper losses”. You have not actually lost the money until and unless you choose to sell those bonds – at which point, you have to account for the difference in what you paid for the bond, and what you received when you sold it again.

How did SVB make a mess of something so fundamental? Partly because they did not appropriately hedge out their financial exposures.

Now, you will often come across people like Jacob Dreizin, who will claim that you cannot lock in yield on bonds. That is not quite true. You can – and investment banks have entire Treasury departments whose job it is to secure the lowest cost of funding the bank’s balance sheet. To do so, they use interest rate swaps to turn fixed-rate assets into floating-rate ones, and vice versa. They also use swaps to transform nominal-yield securities, like Treasuries, into inflation-adjusted securities, like TIPS bonds. It isn’t actually that complicated to do – I have helped setup Strategic Liquidity Reserve books in my time, and I know what it takes to hedge and price these securities.

Where Dreizin is correct in his criticisms, is in his argument that ALL banks, everywhere, have what is called “duration mismatch” – that is to say, they have lots of short-dated liabilities, and not nearly enough liquid assets to cover them all. That is a fundamental fact of banking.

Any deposit-taking bank in a fractional-reserve system, anywhere, has this problem. If you park your money in “the bank”, you think it is safe. But, in fact, EVERY bank in such a system will then underwrite loans of many times the value of your deposits. This means, if you want your money back and withdraw it, the bank then has to do one of three things to give it back to you:

- It must have the cash physically, or digitally, present within the bank;

- It must sell its liquid assets, like Treasuries or cash-equivalent securities, to raise the cash;

- It must sell its illiquid assets, like loans, to get the cash-equivalent amounts;

Note, this is literally Banking 101 – I cannot make it any simpler than that.

But… what happens when a bank does not have the cash physically present in its vaults? And cannot sell its bonds without eating a huge loss? And cannot sell its loans easily, because the loans market has dried up and nobody wants to borrow at insanely high mortgage rates?

Then, that bank is COOKED.

And this comes back to the one fundamental issue that Ms Hartmann does not address – what happens with bank failures.

In a well-functioning financial system, banks do not get bailed out. Depositors, who are essentially creditors of a bank – quite literally, in fact – take a huge haircut on the debts their bank owes them. Equity holders get wiped out. Everyone learns an extremely harsh lesson, the bank goes out of business, and those unlucky people who got hurt, have to rebuild somehow.

Far too often, they cannot and do not recover from the loss of their life savings.

It is not nice, and it is definitely not fair. But it IS the only way to ensure that people swallow bitter medicine and learn from their experiences. It IS the ONLY way to ensure banks learn discipline, prudence, appropriate risk management, and decent behaviour.

What happens, though, when Big Daddy Gubmint steps in and backstops literally everyone in an economy? What happens when EVERY bank becomes effectively too big to fail?

Then you have a situation where banks get privatised profits and socialised risks. This is PRECISELY how bank failures grow and multiply over time, until even a single moderate-sized bank failure means the ruination of an entire financial system.

I conclude by noting that I fundamentally agree with Ms Hartmann’s final advice about continuing to invest in stocks. I STRONGLY disagree with those who think the stock market is a casino – in the long run, i.e. over time horizons of 10 years or more, it simply isn’t. If you insist on investing your money for 5 years or less, then yeah, you’re gambling. But, if you find quality companies and analyse their balance sheets and business models carefully, then you can find great discounts in a time of deep fear and uncertainty. Or, you can adopt a passive index-based investing strategy, which works long-term, even after accounting for inflation.

But that does not mean you should not think about diversifying into other assets. Keep in mind, I am not an investment adviser, I simply know a thing or three about this stuff. So, consider diversifying into precious metals, real estate, and other assets. The overriding lesson from bank failures is that keeping all of your savings and funds in one place is extremely dangerous – and, the broader lesson here is that the USSA is rapidly devolving into something FAR WORSE than a banana republic. The dysfunctional and corrupt financial system there is something we should all move away from, wherever possible.

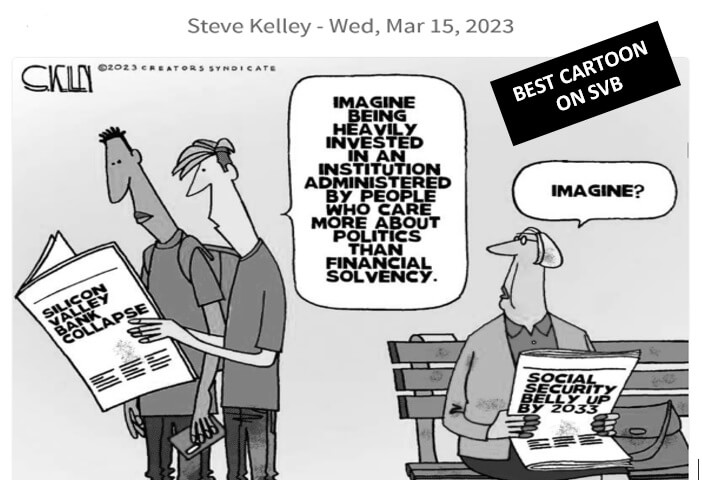

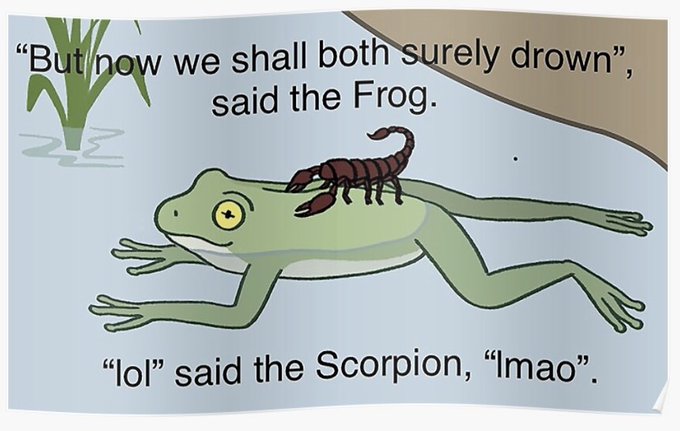

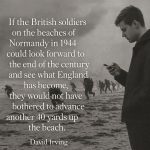

I leave you with some dank memes from Dawn Pine:

1 Comment

The Fed raised rates another quarter again today, although they hinted and only raising one more quarter by year’s end. There will be more banks fall in similar fashion before it’s over. Rates were kept too low for too long, and nobody planned on the party ever ending. The hangover is now here. We’re going to see who drank their Gatorade. Wells Fargo exited the correspondent mortgage space two months ago, as did Rushmore back in the fall. That’s not small news.

Just to add some color, the 2.5 coupon MBS was trading somewhere around 102 in mid-2021. It can now be had for about 80. As the article noted, this is fine as long as the holders of these coupons don’t have to sell (a mortgage at 2.25% is a very safe bet to avoid early pay-off when current rates are four points higher). Higher rates always lead to liquidity problems while lower rates leave lenders flush with cash, but when rates rise as quickly as the Fed has pushed them, it’s bad news. We haven’t seen the last of the bank run, I’m certain of it.